how does hawaii tax capital gains

You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. Tax Clearances for State and County Contracts.

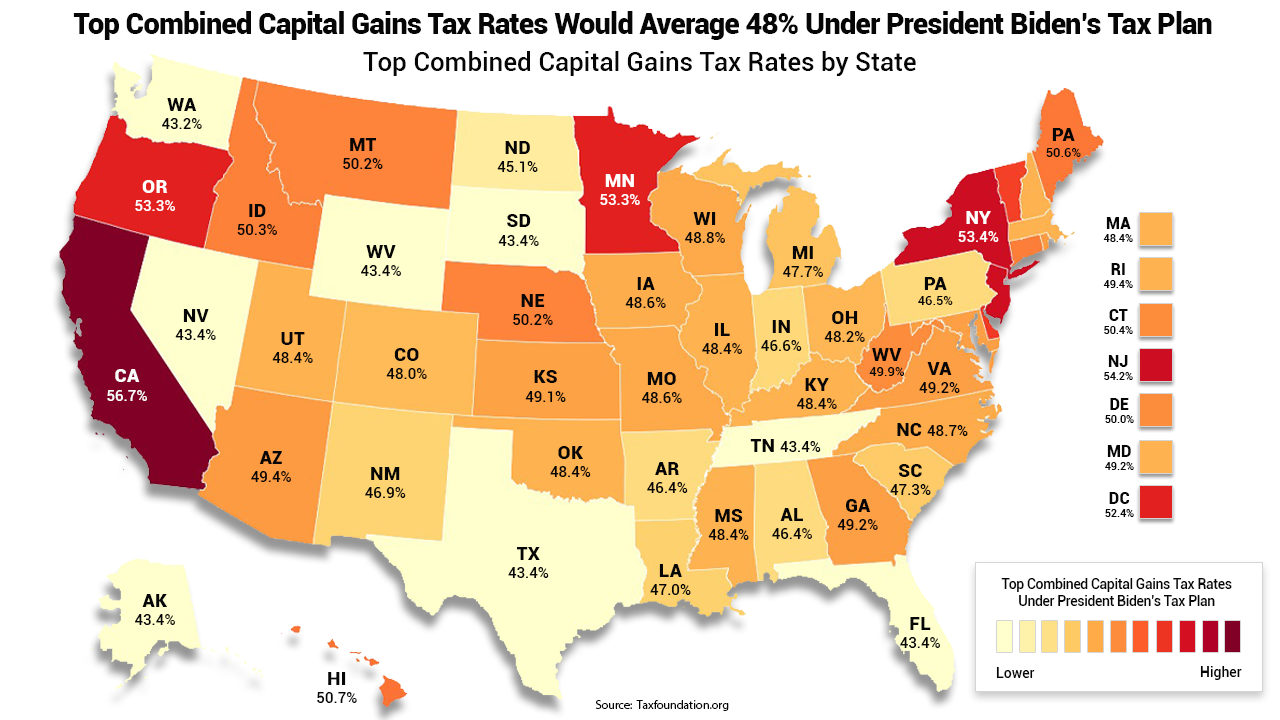

How High Are Capital Gains Taxes In Your State Tax Foundation

Hawaii tax forms are sourced from the Hawaii income tax forms page and are updated on a yearly basis.

. Other factors in determining gain are. Hawaii also has a 440 to 640 percent corporate income tax rate. The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring states in 2015.

If the appropriate Hawaii income tax return ex. What is the actual Hawaii capital gains tax. House members take their oaths of.

The rate that the transfer is taxed at depends on its value. Hawaiis capital gains tax rate is 725That applies to both long- and short-term capital gains. 2022 State Capital Gains Rates Income Tax Rates and 1031 Exchange Investment Opportunities for the state of Hawaii.

The rate slowly goes up in seven iterations until you reach the highest rate which is 1 for property transfers of 10000000 or more and 125 for non-residents. For Hawaii residents transferring under 600000 the rate is 01 of the value or 015 for non-residents. You do this by filing a non resident Hawaii Income Tax form known as Form N15.

In cases where you paid all of your GE TA and capital gains taxes owed to Hawaii and the income tax owned to Hawaii on computed capital gains are less than the amount withheld you can file for a refund of the HARPTA withholding. Tax Law and Guidance Hawaii Taxpayers Bill of Rights PDF 2 pages 287 KB October 2019 Tax Brochures Tax Law and Rules Tax Information Releases TIRs. Form N-15 for the year is available then the owner should file the.

Taxes in Hawaii Hawaii Tax Rates Collections and Burdens. General coverage of federal laws that are relevant to Hawaii income tax or Hawaii estate tax Unreported Tax Court Decisions Tax Audit Guidelines. Short-term capital gains are taxed at the full income tax rates listed.

Capital gains are currently taxed at a. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing. Learn about Hawaii tax rates for income property sales tax and more to estimate what you owe for the 2021 tax year.

But this might require some waiting. Hawaii taxes gain realized on the sale of real estate at 725. In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed aboveLong-term gains are those realized in more than one year.

Information on Hawaii State Taxes for Taxpayers Doing Business in Hawaii. Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries.

The 2022 state personal income tax brackets are updated from the Hawaii and Tax Foundation data. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. Licensing and Tax Information for New Businesses.

Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii. If the collected amount is too large how do you obtain a refund. The Hawaii capital gains tax on real estate is 725.

How does Hawaiis tax code compare. A capital improvements made while owning the property. Capital Gains Tax in Hawaii.

Hawaii has a graduated individual income tax with rates ranging from 140 percent to 1100 percent. Digest of Tax Measures. Hawaii has a 400 percent state sales tax rate a 050 percent max local sales tax rate and an average.

Gain is determined largely by appreciation how much more valuable a property is when sold compared to the price paid when it was purchased.

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

How Do State And Local Individual Income Taxes Work Tax Policy Center

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

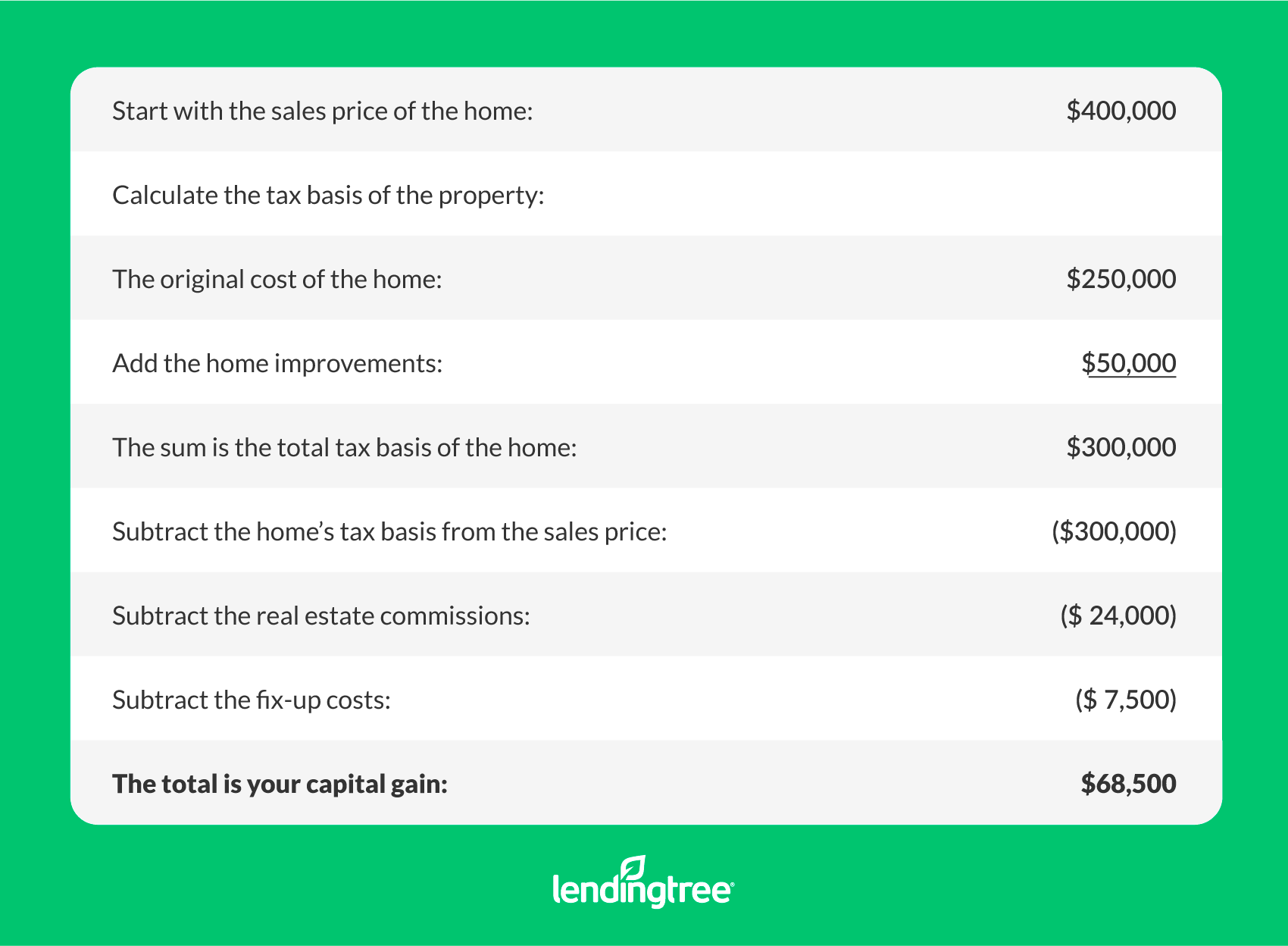

Capital Gains Tax On A Home Sale Lendingtree

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Hawaii Income Tax Calculator Smartasset

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

The States With The Highest Capital Gains Tax Rates The Motley Fool

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

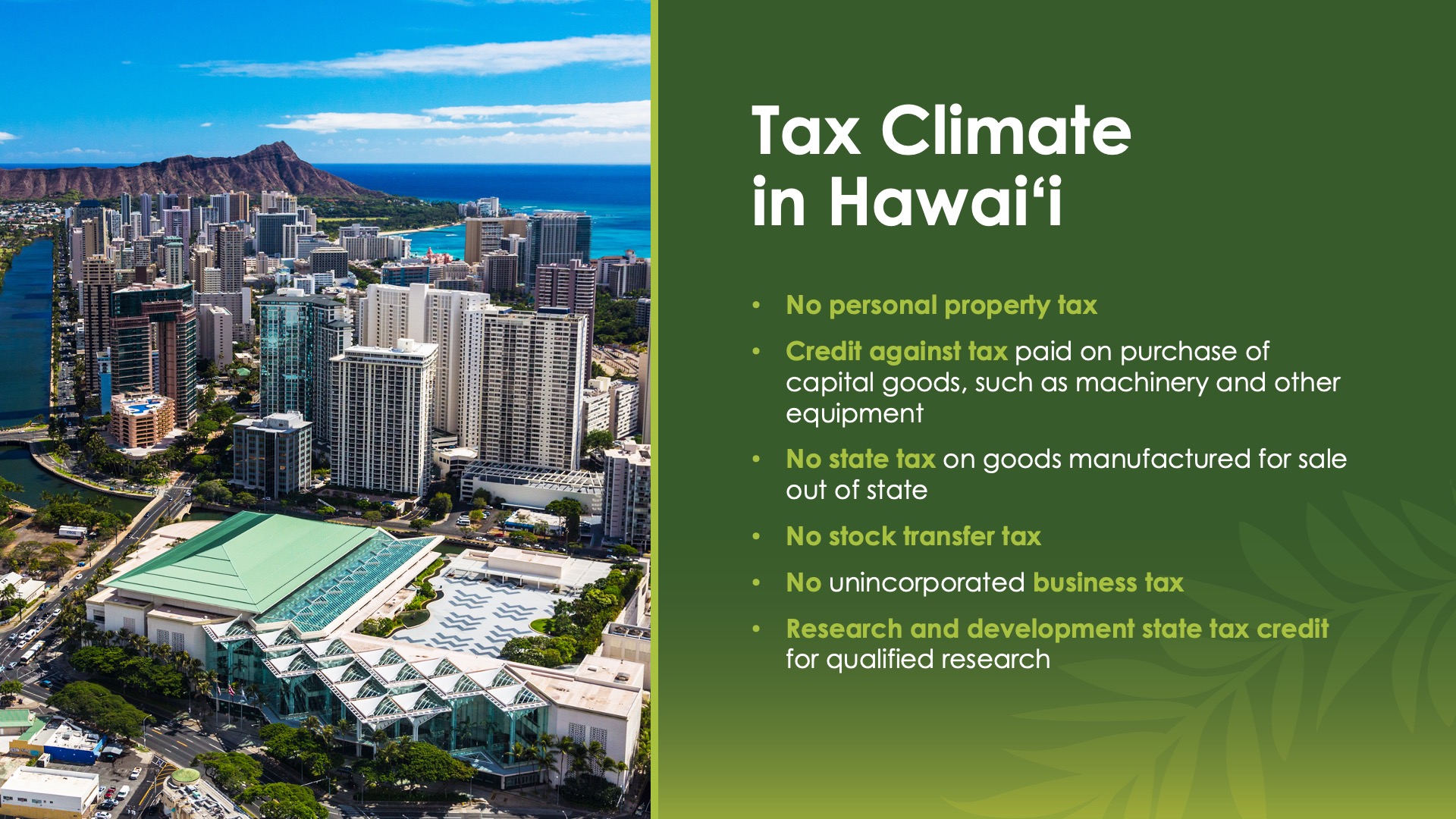

Business Development And Support Division Tax Incentives And Credits

2022 Capital Gains Tax Rates By State Smartasset

Mapped Biden S Capital Gain Tax Increase Proposal By State

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Hawaii Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition